Working with the Australian Government and the Australian Distillers Association, Convergence.Tech has delivered a world-first blockchain pilot program that it says has the potential to recover at least $45m in lost tax revenue.

The six month pilot cost $3 million, is now completed and has been declared a success on two fronts. Firstly, Convergence say that it demonstrated that the blockchain platform improves brand protection and provenance, levels the competitive field by removing illicit products and reduces red tape.

Secondly, for the regulator and taxpayers, project partner KPMG estimates that the program could lead to the collection of at least $45m per year in tax revenues that were previously lost.

The Australian distilling industry agrees that significant change is required to update a century old tax system which is burdensome, inefficient and inaccurate and are hopeful that blockchain technology will be used in the future.

Currently they are mired in administrative oversight, cashflow impediments and fighting a market burdened with illicit activity.

“Australian Craft distillers will benefit from their brands having greater protection from illicit competition through the scaled uptake of the blockchain. Australian spirit producers will embrace the technology because it will make their obligations easier and unlocks opportunity for even more significant improvements,” says Australian Distillers Association CEO, Paul McLeay.

The blockchain program – if implemented beyond the pilot and this weekend’s election – would lead to significant financial benefits for distillers as well: tax is not paid on the product until it is sold in store or on-premise. Currently, distillers pay the tax on the product as it leaves the door.

But first, a look at how it works.

HOW IT WORKS – STEP BY STEP

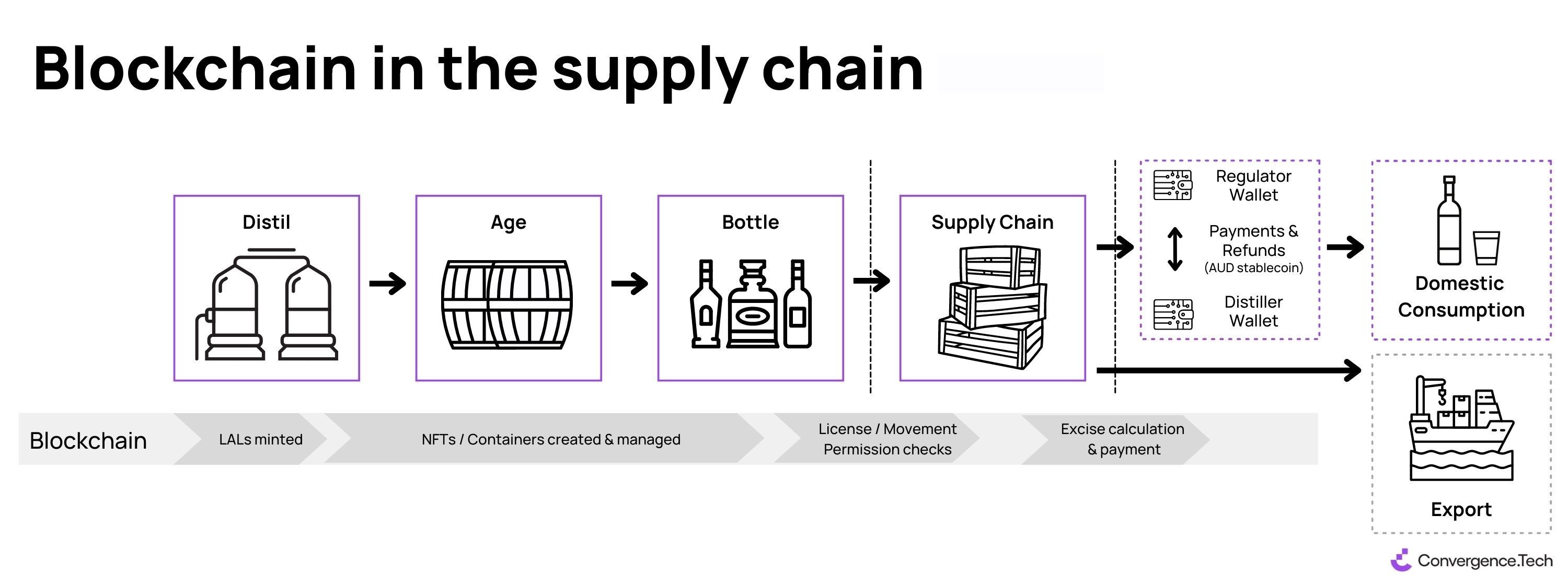

- The Blockchain platform tokenises the pure litres of alcohol into a commodity stablecoin. The pilot used ANZ stablecoin.

- These tokens are nested within NFTs representing inventory – stills, vats, casks/barrels, crates and bottles.

- These NFTs are traced throughout the Distiller’s operations and then as each distinct container moves through the supply chain.

- The ATO has access to the blockchain, enabling real-time tracking of spirit movement and tax obligations.

- The Private Permission Blockchain Platform means that individual entities only have visibility of date relevant to their needs.

- The pilot used ANZ stablecoin which links the commodity stablecoins on the platform to a flat currency. This provides liquidity.

- ANZ Bank also supplied custodian services for distiller and wholesalers’ valuable digtised inventory, enabling immediate transfers, remittance and refunds through secure digital wallets.

OUTCOME

The solution enables greater transparency and trust between participating distillers, wholesalers and the regulator. This liberates Spirits producers from expensive red-tape and allows them to focus on crafting, distribution, sales and marketing of their product.

For the Government, it will contribute significantly to reducing the alcohol tax gap, currently estimated at $582m (2018/19).

Australian Distillers Association

Mr McLeay says blockchain makes life more straightforward and the distilling business more transparent. Being able to pay the excise later is one of the key attractions, especially for smaller craft distilleries.

“At the moment distillers are obliged to pay the excise as soon as it enters the market. But with blockchain, the payment only becomes a reality once the consumer has paid for the product,” he explains.

“It works on multiple platforms as long as it is being sold via a trusted supplier. It benefits producers and in the tax that it captures, it benefits citizens.”

He says that the only people that the blockchain technology is bad for are those who cheat on their taxes. He also believes that smaller distributors will be able to sell their product to the wholesaler at a lower cost and that this could be passed onto consumers.

“There is a genuine saving to be passed onto the consumer,” he said.